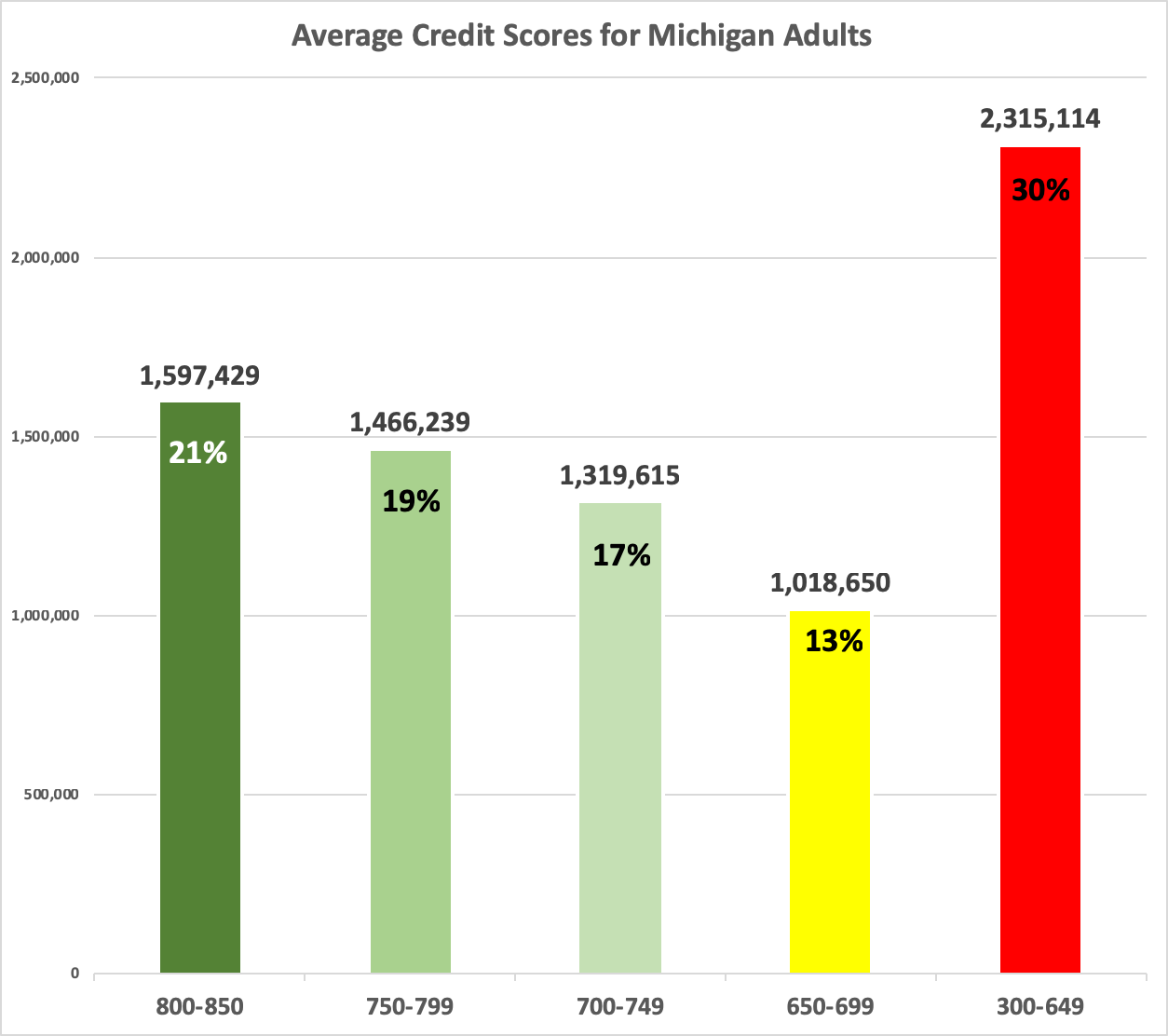

Michigan Lending Facts wanted to give you a snapshot of the average credit scores of your constituents. These estimates are based on U.S. averages as they apply to Michigan’s adult population.

What does this mean for these borrowers? Quite simply, the lower the credit score the less options borrowers have to meet their needs. It also means that their cost of credit goes up to meet the risk of the lenders.

So what is the solution? Allow for more state regulated options for borrowers in need at any level. With more options consumers win because they have choices to fit their specific needs and they have the consumer protections they deserve. While some in the legislature want to remove options to those with low credit scores, the legislature should be looking at the 2.3 million that need their help and expand regulated lending options to them.