CLICK HERE TO WATCH THE FULL PANEL DISCUSSION

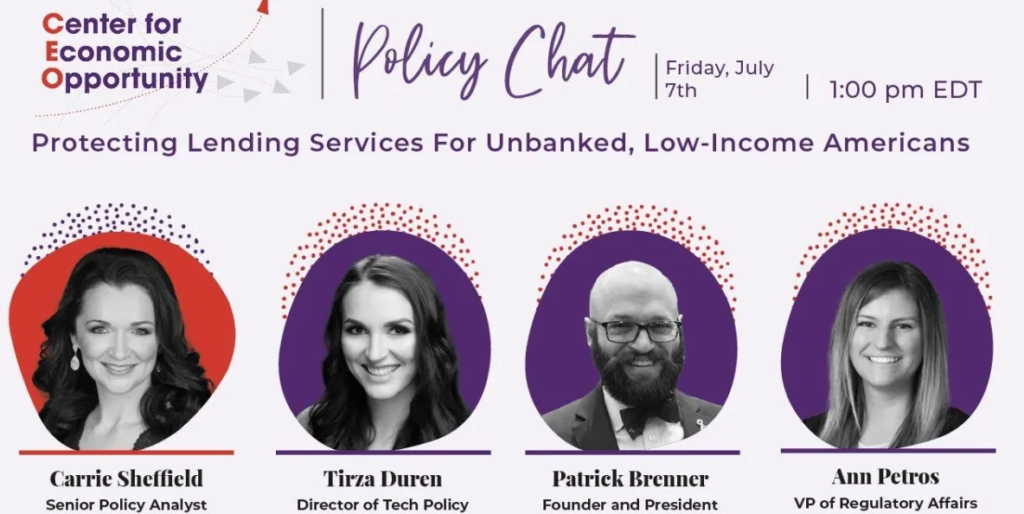

Recently the Southwest Public Policy Institute joined Carrie Sheffield from the Independent Women’s Forum, Tirzah Duren from the American Consumer Institute, and Ann Petros from the National Association of Federally-Insured Credit Unions for the panel discussion “Protecting Lending Services For Unbanked, Low-Income Americans”, part of IWF’s Center for Economic Opportunity Policy Chat series.

In today’s cashless society, where most Americans utilize checking and savings accounts, credit cards, and loans for significant purchases, it is important to acknowledge that a significant portion of the population faces obstacles when it comes to accessing and maintaining financial accounts. These challenges can make daily life more challenging, especially in the face of rising inflation.

However, it is crucial to understand that despite the lack of access to financial services, they are still highly desired and needed, particularly by low-income households. Fortunately, various lending services bridge the gaps in the market, such as check protection services and installment loans. It is essential for the public and policymakers alike to recognize the vital role these services play.

While it may be tempting to criticize those who specialize in serving this population and view their fees and practices as exploitative, it is crucial to consider the critical need these services fulfill. Providers must take into account the short-term nature of the loans and the higher risks and costs associated with providing these services. In fact, some of the most heavily criticized financial practices, such as installment loans or “payday lending,” and check protection services, actually enable vulnerable communities to participate more fully in today’s technology-driven economy. Without these services, individuals may be compelled to turn to the black market, exacerbating their lack of access to banking and loan products.

Policymakers should contemplate implementing policy reforms that encourage ongoing innovation in the financial sector. It is important to recognize that consumers are best positioned to determine which services meet their specific needs at any given time. While regulators may have the best intentions, their interventions often restrict consumer choice, resulting in fewer options and higher costs. Therefore, it is crucial to strike a balance that ensures consumer protection without stifling innovation and limiting available choices.